The PoleOS™ Company

IKE Announces Fully Underwritten A$21.3m Capital Raising

Press Release

Highlights

- IKE has completed a fully underwritten share placement to raise approximately A$18.3m (approximately NZ$19.2 million) with strong demand from new and existing investors including multiple new ASX institutional investors.

- A fully underwritten Share Purchase Plan (SPP) of A$3.0m (approximately NZ$3.1m) will follow, with the ability raise a higher quantum subject to demand and Board discretion. The SPP will open on 16 August 2021 and is expected to close on 26 August 2021.

- Proceeds from the Placement and SPP will support recent customer wins, help accelerate a growing sales pipeline, and provide flexibility to pursue potential acquisition opportunities.

ikeGPS Group Limited (ASX/NZX:IKE) (‘IKE’ or the ‘Company’), the company setting the standard for collecting, managing, and analyzing pole and overhead asset information for electric utilities, communications companies and their engineering service providers, is pleased to announce it has successfully completed a fully underwritten share placement of new fully paid ordinary shares (‘New Shares’) to raise approximately A$18.3m (approximately NZ$19.2 million). The New Shares will be issued to new and existing sophisticated investors (‘Placement’).

Commenting on the successful Placement, IKE’s CEO, Glenn Milnes, said: “We are extremely pleased by the level of support we have received from our loyal shareholders as well as new institutional funds. This support places us in a strong position to execute against our business plan and our goal to be the standard for the collection, analysis, and management of distribution assets for electric utilities, communications groups and engineering service companies in North America.

“IKE has strong market tailwinds in North America which we expect will continue to support long-term growth, with more than US$350b forecast to be invested into fiber and 5G infrastructure over the next five-plus years, and with more than 3,000 electric utilities needing to address the challenges of network build, strengthening, and maintenance. Our solutions meet these needs in delivering network construction and maintenance processes that are faster, safer, and to a higher quality data standard.

“IKE has emerged from COVID-19 and its challenges in a strong position, demonstrated by the sales performance of the past two quarters where we closed approximately NZ$11.5m of new contracts against FY21 full year revenue of NZ$9.3m. This, combined with a strong sales pipeline and balance sheet, provides us with confidence of delivering substantial revenue growth in FY22 and beyond.”

Placement

Shares from the Placement will be issued at a price of A$0.95 (NZ$1.00) per share representing a 13.0% discount to the volume weighted average price (VWAP) of the Company’s shares as traded on ASX, and a 14.6% discount to the VWAP of the Company’s shares as traded on the NZX, over the 5 days up to and including 6 August 2021 (the last day of trading ahead of the announcement of the Placement).

The New Shares issued under the Placement will rank equally with existing IKE shares on issue with effect from their date of issue.

Bell Potter Securities Limited acted as lead manager, underwriter and bookrunner to the Placement.

Use of funds

IKE will have pro-forma net cash of approximately A$27m (approximately NZ$29m) after completion of the Offer. The proceeds of the Placement and the SPP will be used to support recent customer wins, a growing sales pipeline and providing capacity for potential acquisition opportunities.

Share Purchase Plan

Following the completion of the Placement, IKE will conduct an offer of New Shares by way of a share purchase plan (SPP) that is underwritten to A$3m (approximately NZ$3.1m) to existing shareholders in the Company with a registered address in New Zealand and Australia as at 7.00pm NZST (5.00pm Sydney, Australia time) on Tuesday, 10 August 2021, and who are not in the United States or acting for the account or benefit of a person in the United States (Eligible Shareholders).

The SPP will provide each Eligible Shareholder with the opportunity to apply for up to A$14,300 / NZ$15,000 of New Shares at A$0.95 (NZ$1.00) being the price payable per New Share in the Placement. The SPP is targeting to raise up to A$3 million (approximately NZ$3.1m), while maintaining the flexibility to accept applications in excess of this amount.

If scaling is required, IKE will scale applications having regard to the number of shares held by the applicant on the record date and otherwise at its discretion. In the event of scaling, the value of SPP shares allocated to investors may be less than the parcel initially applied for. If this occurs, any excess money will be refunded (without interest). IKE expects to announce the final outcome of the SPP, including any scaling, on 31 August 2021.

The SPP offer booklet (SPP Offer Booklet) containing further details of the SPP is expected to be released on 16 August 2021 and will be sent to all Eligible Shareholders.

Each New Share issued under the SPP will rank equally with existing Shares with effect from its date of issue and IKE will seek quotation of the New Shares issued under the SPP on the NZX and ASX.

Shareholder approval is not required for the issue of Shares under the SPP.

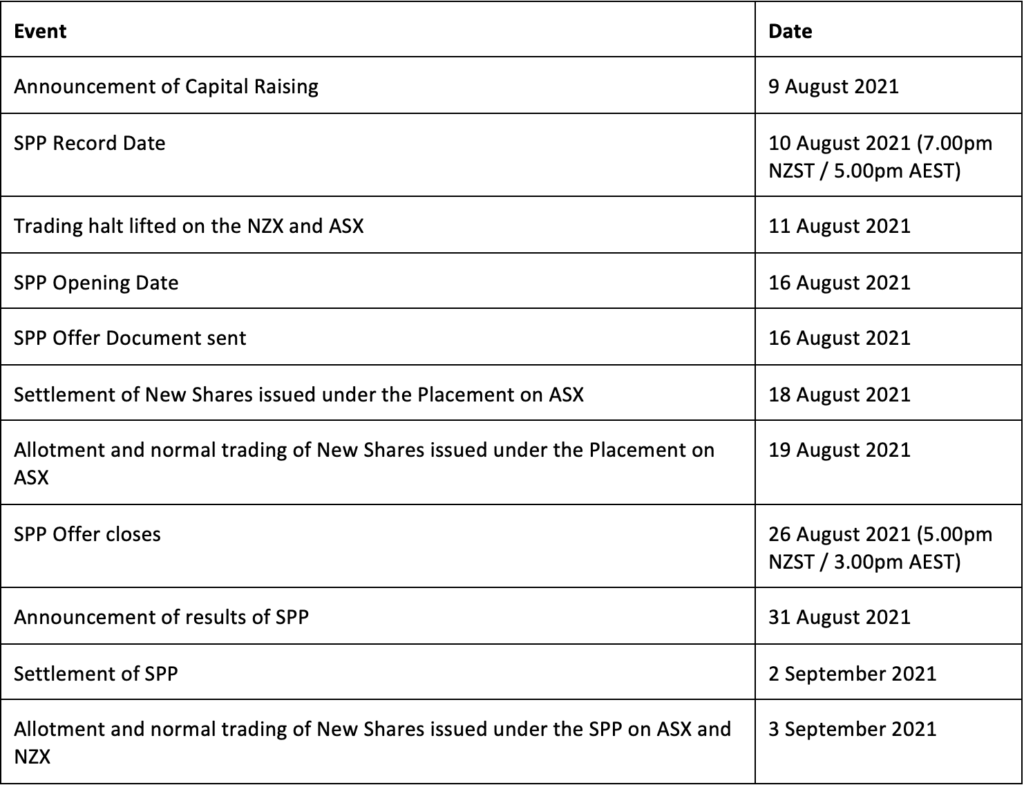

Indicative Timetable for the Placement and SPP

This announcement has been authorised for release to NZX and ASX by the IKE Board of Directors.

ENDS

About ikeGPS

We’re IKE, the PoleOS Company. IKE seeks to be the standard for collecting, analysing and managing pole and overhead asset information for electric utilities, communications companies, and their engineering service providers.

Contact:

Simon Hinsley Investor Relations +61-401-809-653 [email protected]

Glenn Milnes CEO +1 720-418-1936 [email protected]

This announcement has been prepared for publication in Australia and New Zealand and may not be released to US wire services or distributed in the United States. This announcement does not constitute an offer to sell, or a solicitation of an offer to buy, securities in the United States or any other jurisdiction. Any securities described in this announcement have not been, and will not be, registered under the US Securities Act of 1933 and may not be offered or sold in the United States except in transactions exempt from, or not subject to, the registration of the US Securities Act and applicable US state securities laws.

The latest from the IKE Wire

5 critical factors for selecting utility pole field data collection technology

When evaluating utility pole data collection solutions, the initial subscription pric...

Read MoreIKE Office Pro expands field-to-finish process with more integrations to leading pole loading analysis, distribution design, and joint-use software

Latest developments enable best-in-class utility workflows, connecting field data col...

Read MoreIKE product updates: 2025 year in review

Recapping our latest developments in overhead distribution asset management 2025 brou...

Read MoreSubscribe to the IKE Wire

Get the latest insights on data acquisition and structural analysis from the ikeGPS experts.